Evaluating the Degree of Export Readiness of Nigerian Businesses for the African Continental Free Trade Agreement (AfCFTA)

This study aims to do a critical evaluation of the degree of export readiness of Nigerian businesses under the African Continental Free Trade Agreement (AfCFTA). The research method was quantitative, and a survey was used to collect primary data from 118 enterprises of different sizes, in different sectors and locations in different zones and states of the country. The collected data were analyzed using SPSS application and reliability analysis done on the questionnaire using Cronbach’s alpha reliability index was excellent with a value of 0.939. The author identified 15 factors that are responsible for the readiness of a business for the export market, and these are so far, the most comprehensive list of export readiness factors in this field of research. Based on the 15 factors identified for export readiness, the author developed an export readiness assessment model that categorized businesses into 5 categories based on their scores and these include export-ready, almost ready, midway to readiness, just starting, and preparing to start. The export-ready businesses must score 90% above to be deemed ready for the export market. This model was used to assess the readiness of the 118 respondents who completed the questionnaire for this survey. It was discovered that only about 3% of all the businesses were ready for successful and sustainable export business.

Introduction

The African continent has a huge population (over 1.3 billion people) which is a potential market for economic growth and one of the ways to achieve this growth is through increased Intra-African trade. However, these population-induced opportunities on the continent are being harnessed by exporters of goods and services from Europe, Asia, and North America. This has led to a situation where, despite this huge population, total export trade contributions from Africa are about 2.5% of world trade because of low Intra-African trade of about 17%. On the other hand, about 33% of world trade is coming from the European Union (EU) with a population of about 450 million, and about 70% of this, is intra-EU trade (WTO, 2015, p.27).

To reverse this abnormality in Africa, the leaders of African countries converged at Kigali, Rwanda on March 21, 2018, to sign the largest trade agreement in the world called the African Continental Free Trade Agreement (AfCFTA) (Tralac, 2019). According to the International Trade Center (2018), the objectives of the AfCFTA are to create a single market in Africa, increase Intra-Africa trade, boost the competitiveness of African goods and thereby transform the economies of the countries on the continent. The successful implementation of the AfCFTA in different African countries will lead to increased trade among African countries and this will make the businesses in Africa be forced to boost their production capacity and this will consequently stimulate the employment of more people thereby leading to reduced poverty and economic growth on the continent. (PricewaterhouseCoopers, 2019, p.1).

All the efforts that went into the signing of these agreements will be in futility if the African businesses are not ready for internationalization (export ready). According to Svend Hollensen (2014), internationalization involves the expansion of a business operation to different countries in a particular continent like Africa while globalization involves having business operations in other countries located in different continents of the world. The aim of this study, therefore, is to evaluate the readiness of Nigerian businesses for exportation under the AfCFTA.

The reason for embarking on this study was based on the observation made among Nigerian businesses concerning the low volume of export being done to the West African markets under the free trade agreement in the Economic Community of West African States (ECOWAS) called the ECOWAS Trade Liberalization Scheme (ETLS). Even though the government has made several efforts to help the businesses to export to the region through training and sponsoring them to attend international trade fairs, all these have not yielded the desired results in the 30 years of signing the ETLS (ECOWAS, 2019). This is making the author ask this question: how many Nigerian businesses are ready for the export market and how can they overcome the challenges that hinder their readiness for internationalization? These are the question that this study was designed to answer.

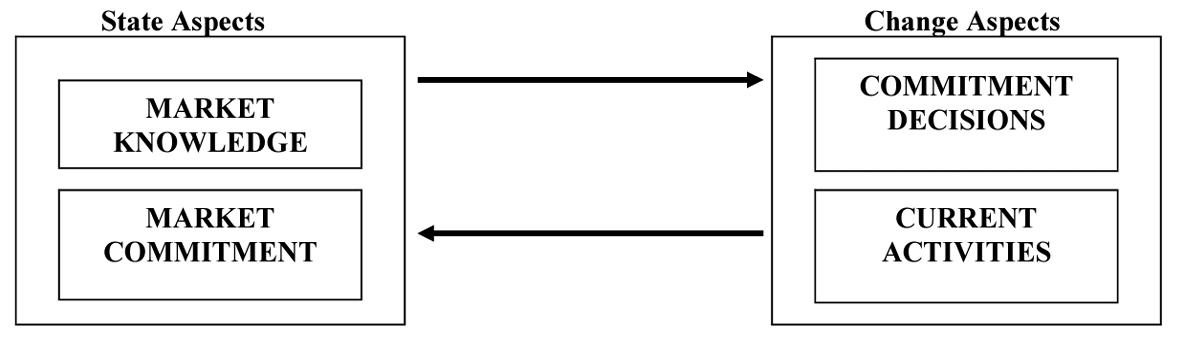

Several studies have been done on the subject of internationalization and this has led to different theoretical models to explain how it works. Some of these models include the Uppsala internationalization model, Transaction cost analysis model, Network model, and the born-global model among others (Hollensen, 2014, p.332). Out of all these theories, the one that has undergone revision to incorporate how a firm becomes ready for internationalization is the Uppsala model. This theory shows how a firm gradually commits more time, money, energy, and other resources into doing business abroad because of the increasing competition in the home market (Johanson & Wiedersheim-Paul, 1975; Johanson & Vahlne, 1977, p.27). What committed to being in a stepwise manner is because, as a business gets involved in exportation it begins to learn and this reduces the uncertainty that leads to more commitment such that the business then moves from the lowest level of commitment, the export mode, to the highest level of commitment which is the investment mode (Tan et al., 2007).

Figure-1

Uppsala Model’s Theoretical Framework

Note. From “The internationalization process of the firm” by Johanson and Vahlne, 1977, Journal of International Business Studies, Vol 8, no 1, 23-32.

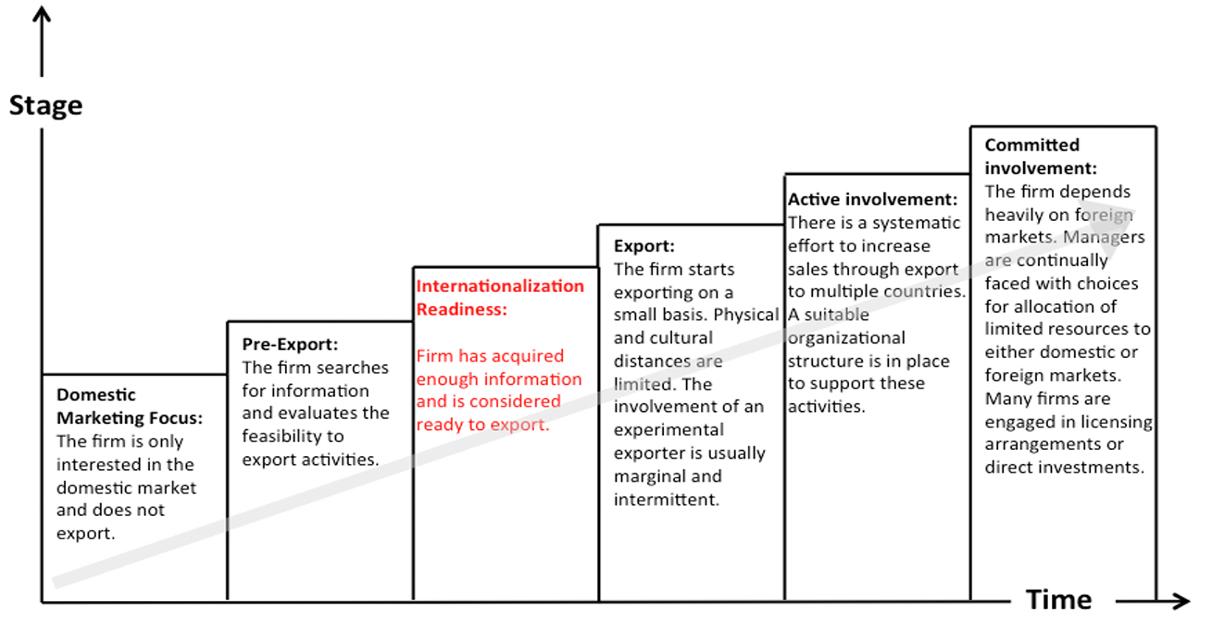

This study is predicated on a combination of two internationalization theories which include the Uppsala model and the pre-export model, and this combination is called the innovation model. Cavusgil (1980) identified the stepwise nature of internationalization in the innovation model and divided it into five stages which were later modified and one of the stages in the modified version is internationalization readiness, which is the focus of this research work. Cavusgil (1984) differentiated the five stages involved in the internationalization process and described them as pre-involvement, reactive/opportunistic, experimental, active, and committed involvement. These five stages were later modified by Gankema et al. (2000) and they came up with the following stages of the internationalization process which include domestic marketing focus, pre-export, export, active involvement, and committed involvement. This was further modified to six stages with the insertion of internationalization readiness as the third stage as shown in Figure-2 below (Elzana & Teodora, 2013, p.37).

Figure-2

The Revised “Five Stages of Internationalization”

Note. From “readiness” When is a firm ready to go abroad? An analysis of SME internationalization by Elzana and Teodora, (2013)

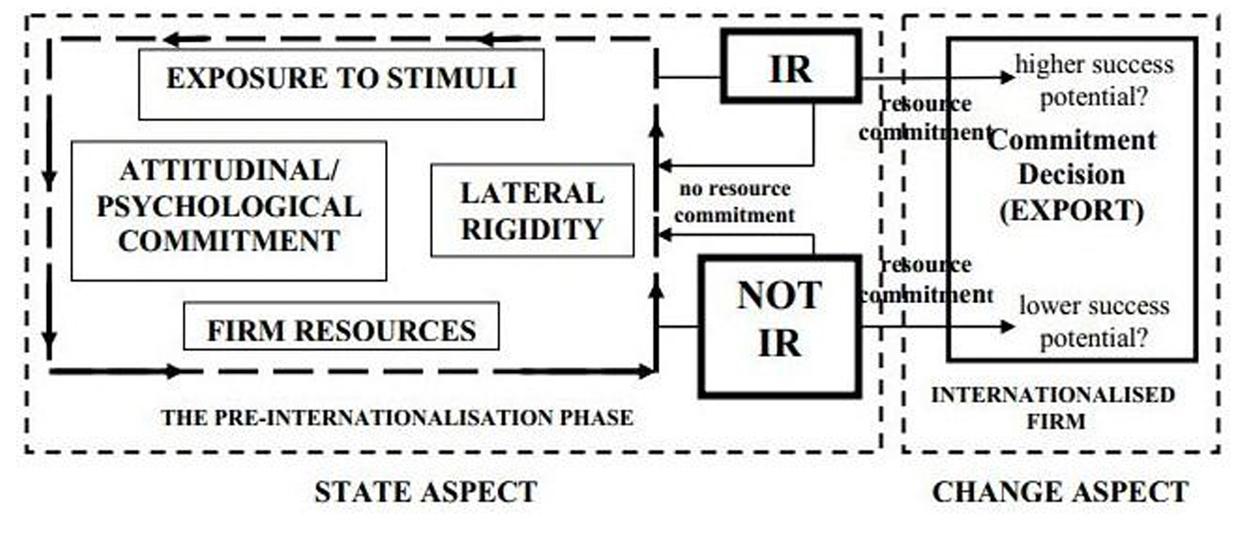

Tan, Brewer, and Liesch (2006) worked on a reframed Uppsala-based pre-internationalization model. This model states that export readiness in the pre-internationalization phase is based on the four components in the learning process. These components include inputs of information from stimuli factors that inspires and motivates the business owners to take action and the motivation is manifested through the psychological and attitudinal commitment and the level of commitment is influenced by the resources and other attributes of the business and the decision of business owners controlled by the lateral rigidity (Tan, Brewer and Liesch, 2006)

Table-3

Reframed Uppsala-based pre-internationalization model

Note. from “Before the First Export Decision: Internationalisation Readiness in the Pre-Export Phase” by Tan, A., Brewer, P. & Liesch, P. W. (2007).

Methodology

This study is aimed at evaluating the readiness of Nigerian businesses for the export markets under the AfCFTA. This is therefore descriptive research because its objective is to paint a picture of the readiness of Nigerian businesses for the export markets. In addition to this, the outcome of this work will be generalized on a broader scale among Nigerian businesses. This there explains the reason why the methodology deployed in this study was quantitative (Alan, 2012).

This study was done using a survey design and this was executed using the descriptive characteristics of an exporter-ready business as identified and collated in the literature reviewed by the author. These descriptive attributes were rated using the Likert type of survey. This survey approach was used to collect primary data from respondents, who are representative of businesses located in different states and geopolitical zones of Nigeria. The research involves probability simple random sampling, and this was done among businesses from different parts of the country, in different sectors of the economy, of different sizes, and from different Organized Private Sectors (OPS).

The data of this study were collected with a questionnaire that has 16 sections with a total of 50 questions. The first section is the preamble which consists of five questions regarding general information of the business. The second section has 15 subsections and a total of 45 questions which assessed the export readiness of a business in 15 areas (the 15Ps of business readiness for internationalization) which include: promoter, products, pricing, personnel, purpose, promotion, proficiency, production, payment, positioning, partnership, purchasers, people, paperwork, and potential.

The data were collected using a questionnaire and a Likert scale was used to rank the responses and this made the codification and response measurements an easy task. The respondents were representatives of businesses producing value-added manufactured goods. The questionnaire was prepared with a survey monkey application online and the link to the questionnaire was sent to 1,118 representatives of different businesses scattered all over the country. A pilot survey was conducted among 16 respondents and the feedback led to the redrafting of the questions and reduction of the total number of questions from 80 to 50. The number of respondents that filled and submitted the revised questionnaire was 152, but only 118 respondents were able to submit a filled questionnaire. The feedback from the remaining 34 respondents that submitted incompletely filled questionnaires were discarded. The collected data was analyzed using the SPSS statistics application. The value of the reliability analysis done for all the questions under the 15 export readiness criteria was 0.939 which is excellent because it falls within the range of α ≥ 0.9.

Results and Discussion

Upon completion of the survey, the responses on the Likert scale were then coded with “strongly agree” assigned number 5, “agree” assigned number 4, “neither agree nor disagree” assigned number 3, “disagree” assigned number 2, and “strongly disagree” assigned number 1. The file of the coded data was imported into the SPSS application for analysis. The data was then transformed by finding the mean of the coded responses under each of the 15 areas of readiness in the questionnaire.

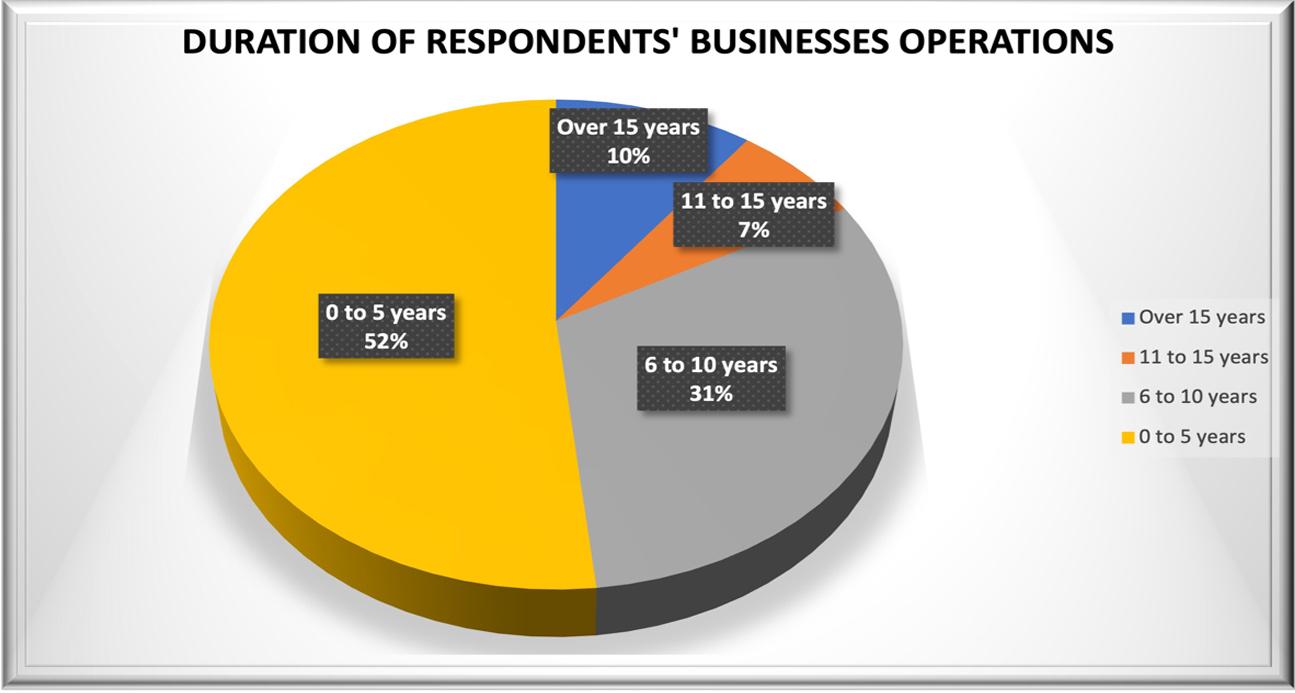

Figure-4

Duration of Respondents Business Operations

The feedback from the respondents as shown in Figure-4 revealed that 10% of the businesses have been operating for over 15 years, 7% has been in existence for 11 to 15 years, 11% have been in business for 6 to 10 years while 52% have been in operation for less than 6 years. The fact that the businesses of many of the respondents were less than 6 years speaks to the high mortality rate of businesses in the country, and this could also be because most young businesses are owned by younger people who are more technologically savvy and could therefore see the link on time and fill the questionnaire within few days when compared to the older generations who own the older businesses.

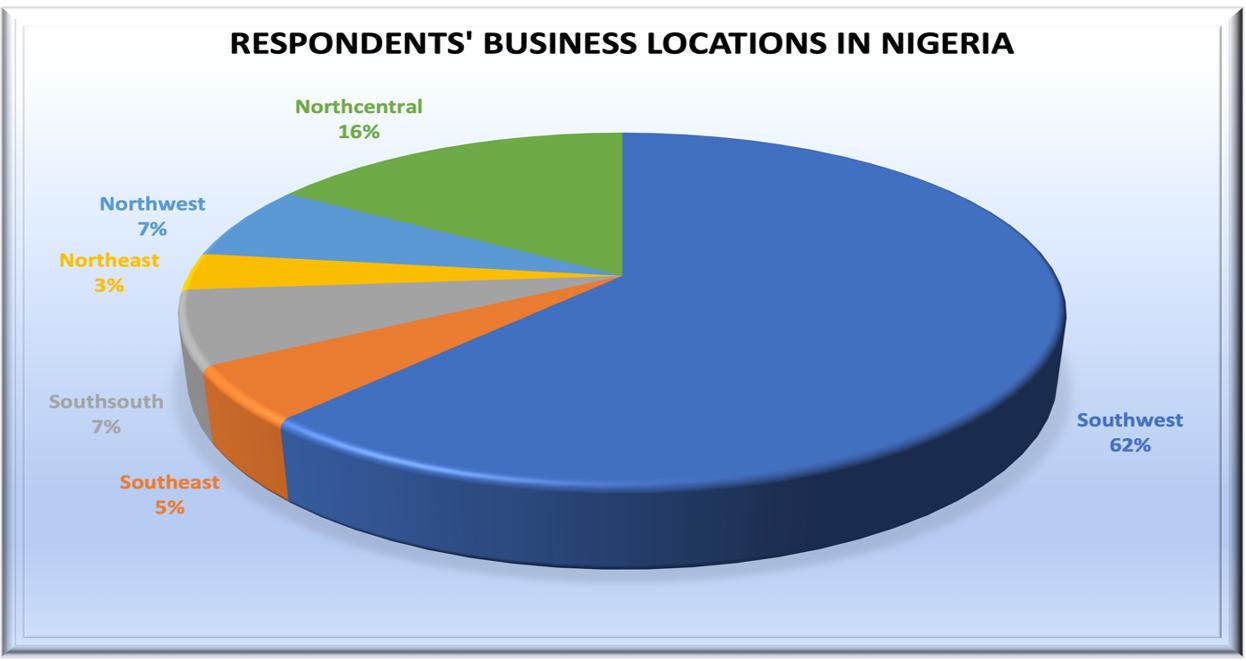

Figure-5

Respondents Business Locations in Nigerian

Figure-5 above showed that the majority of the respondents amounting to about 62% come from the southwestern zone of the country. This is because this zone houses Lagos state, the commercial capital of the country, where many entrepreneurs are operating from because of its large population and nearness to the seaport. The next to the southwest is the north-central zone with about 16% of the respondents. The state with the least number of respondents of about 5% is the southeast and this is because the majority of the businesses in this zone are importers and traders and not manufacturers.

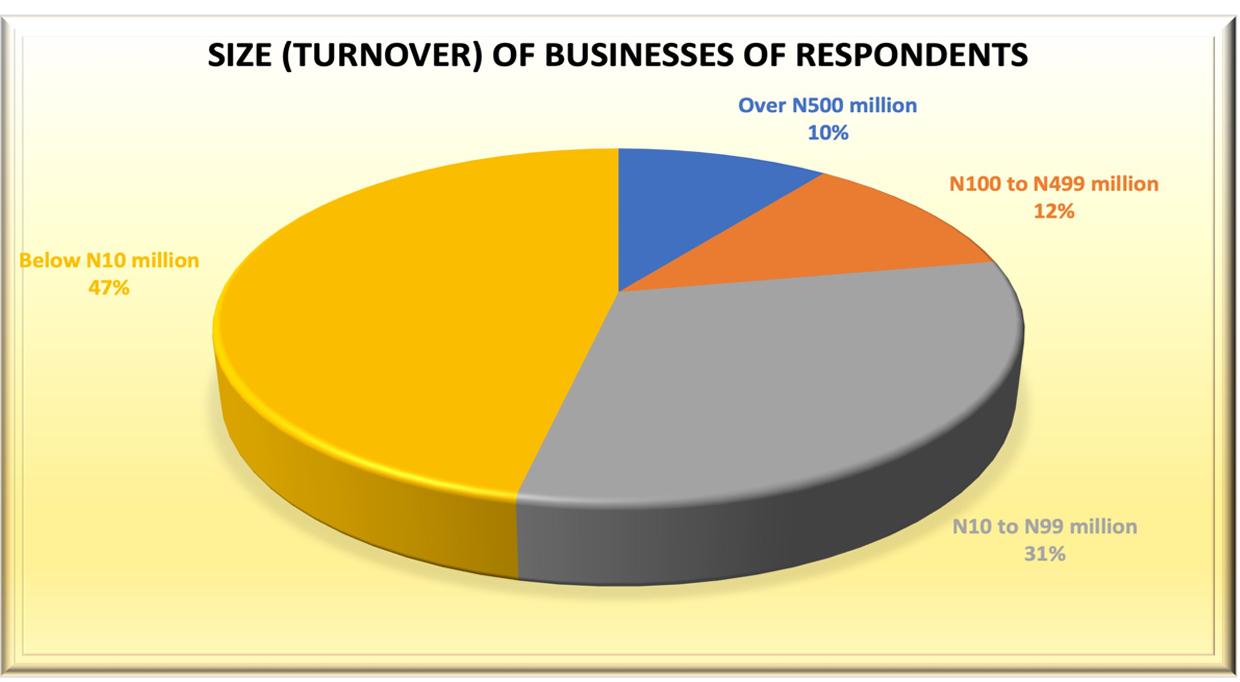

The chats in Figure-6 below showed that the majority of respondents amounting to 90% are within the Micro, Small, and Medium Enterprises (MSME). This is a true reflection of the sizes of businesses in the country as reported by the National Bureau of Statistics (2019).

Figure-6

Size (Annual Turnover) Business of Respondents

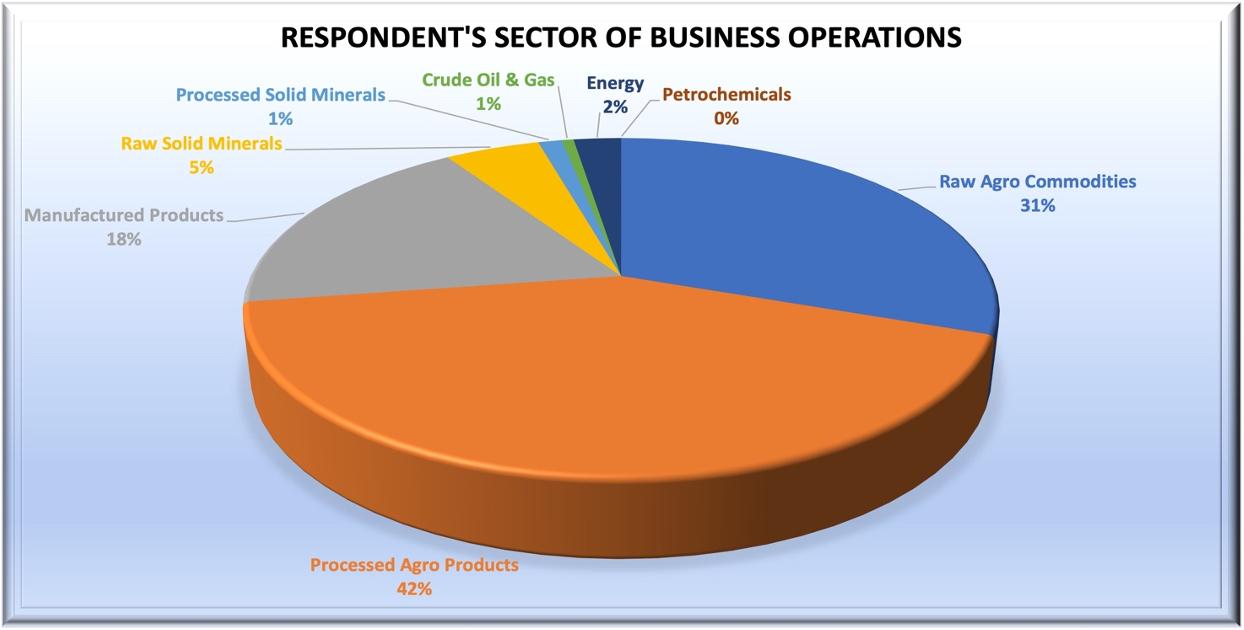

Figure-7

Respondent’s Sectors of Business Operation

Figure-7 above showed that respondents from sectors that produce Processed Agro products, Manufactured products, and Raw Agro Commodities took up about 91% of the total respondents that participated in this survey. The thriving business among the MSMEs in the Nigerian economy is Agro-allied products and that explains the reason why the majority of the respondents are from this sector (NBS, 2019).

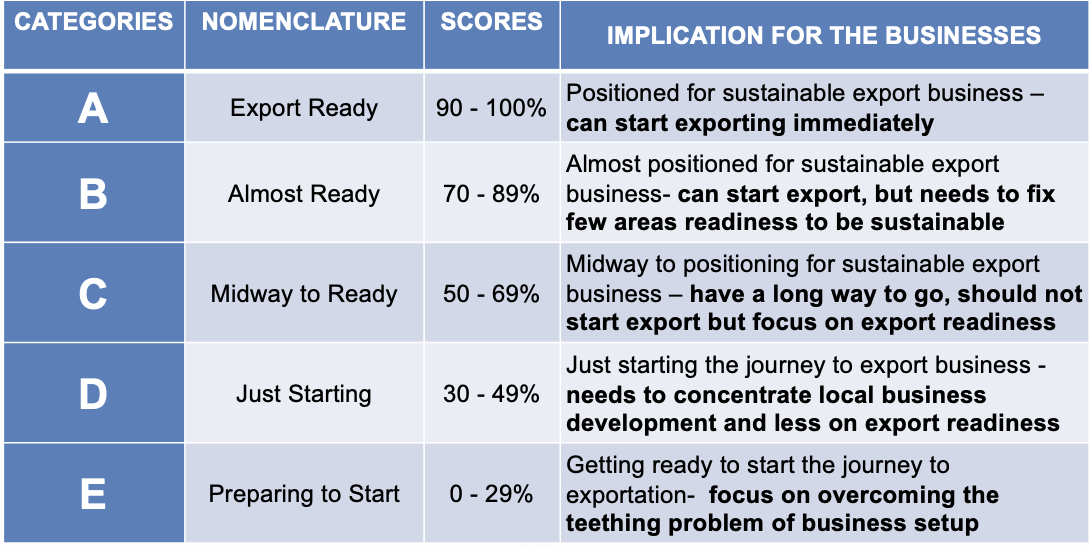

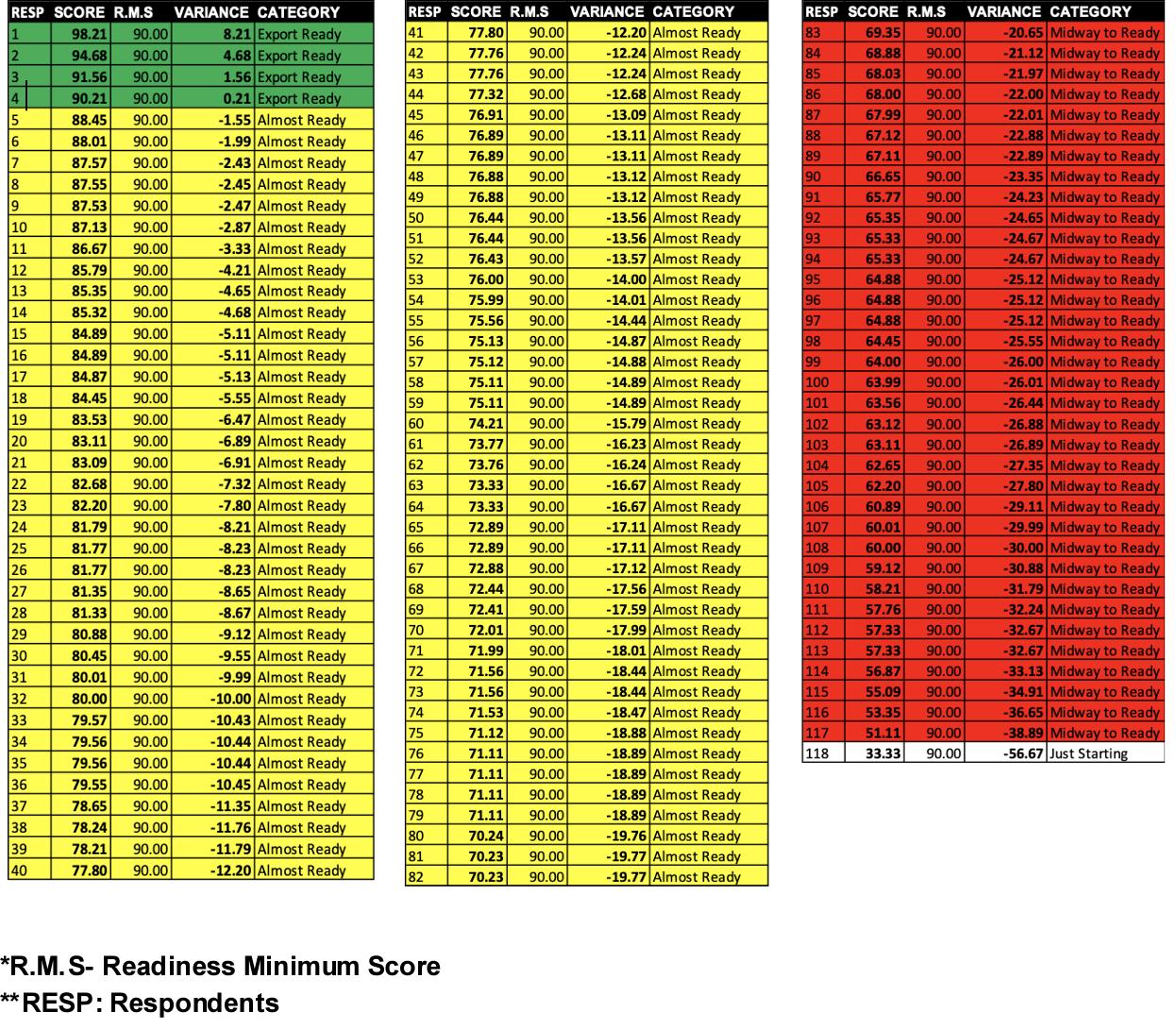

The export readiness assessment was done for the respondents based on the model developed by the author. The model has five categories which include categories A, B, C, D & E. Category A is the highest category, and businesses in this category are deemed to be positioned for export and therefore ready for internationalization while category E is the lowest and the businesses in this category are just getting ready to start the journey towards export readiness.

The overall score of each respondent based on the Likert scale was used to assess them on the export readiness model. The Likert scale has 5 levels of answer choices with each having a point assigned as follows: strongly agree (5 points), agree (4 points), neither agree nor disagree (3 points), disagree (2 points), strongly disagree (1 point). The assessment model has 15 criteria and each criterion has three questions. The score used per export readiness criterion is based on the average score of the three questions under each criterion. Therefore, the highest score possible per participant is 5 (the highest score on the Likert scale) multiply by 15 criteria and this is equal to 75. To determine the Export Readiness Assessment Score (ERAS) of a business, the Actual Assessment Score (AAS) is divided by Total Obtainable Score (TOS) and multiplied by 100%.

ERAS = (AAS/TOS) X 100%

Figure-7 below showed that the first column contains the five categories (categories A, B, C, D & E) of businesses that emerge after export business readiness assessment. It also showed in the second column, the nomenclature which is the description of each of these categories. The third column contains the upper and lower band of scores that represent each category of export readiness and finally, the fourth column contains the implication of each categorization for the business. After calculating the ERAS using the formula above, the score is then used to find the category that the business belongs to.

Figure-8

Export Readiness Assessment Model (Author)

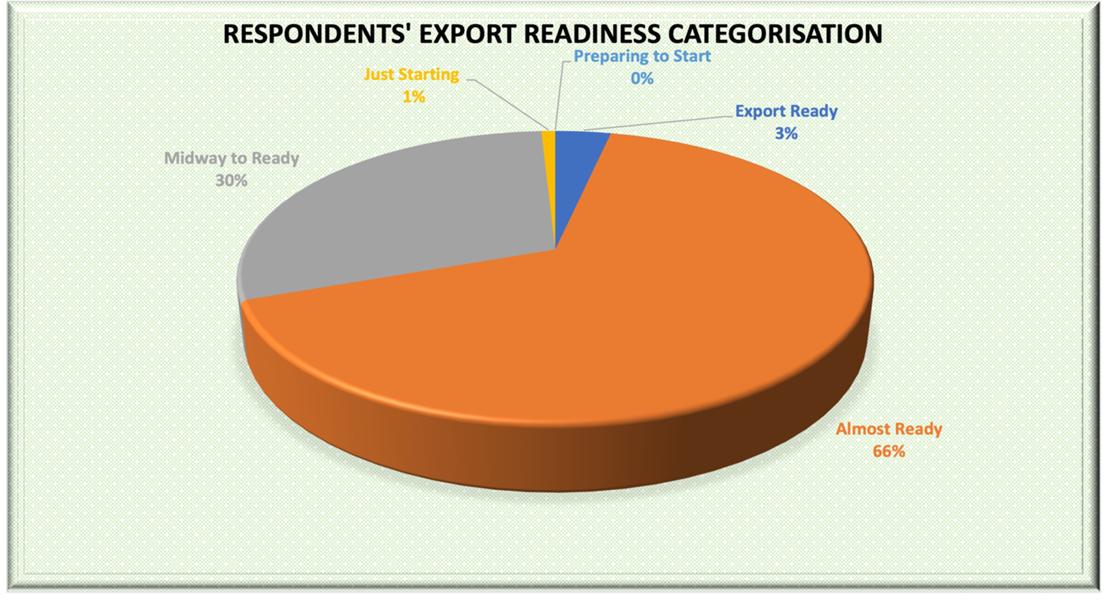

This export readiness model was used to assess the 118 respondents that completed the questionnaire of this study. The results, as shown in Figure-9 below showed that only 4 respondents representing 4 businesses are export-ready. This means that only about 3% of Nigerian businesses fall in category A and are therefore ready for internationalization. That means only 3% of Nigerian businesses have the systems and structure that have made them well-positioned for successful and sustainable export business.

Figure-9

Respondent’s Export Readiness Categorization

The fact that very few Nigerian businesses are export-ready explains the reason why the export volume (particularly non-oil export done by the private sector) has remained very low for many years (NBS, 2018).

Figure-10

Export Readiness Assessment and Categorization of Respondents Company

Recommendation and Conclusion

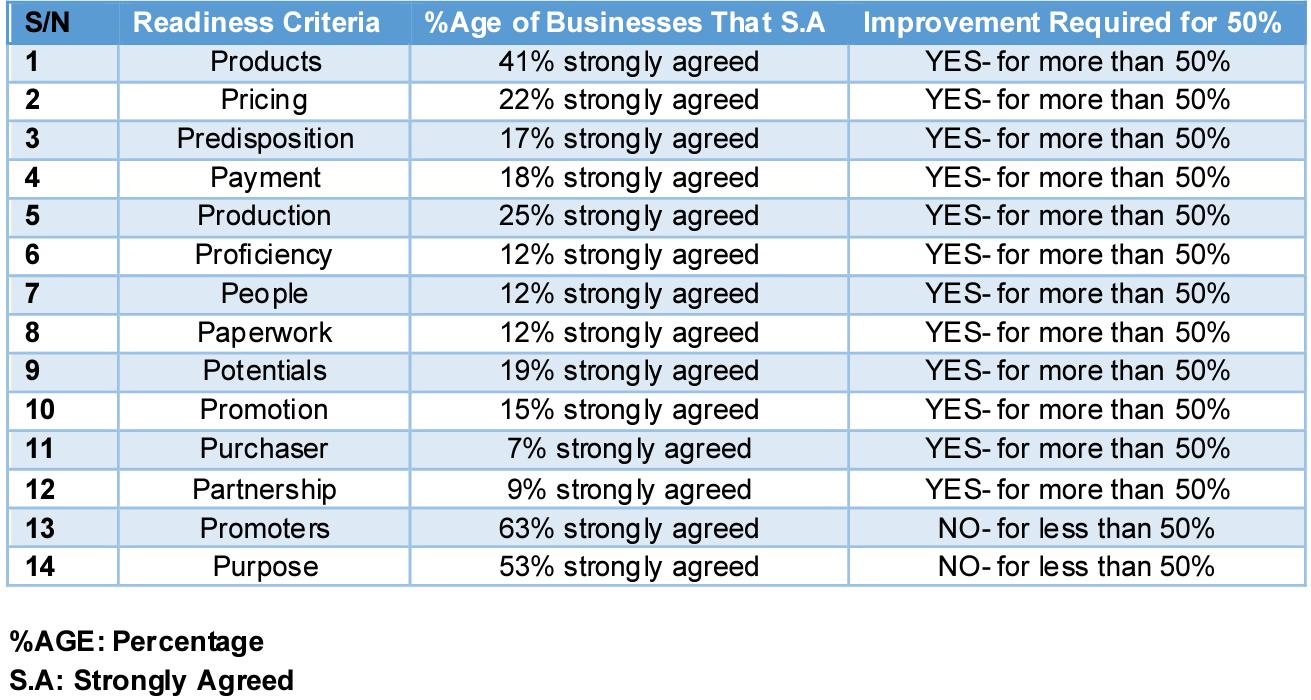

This research was done to identify the problem that is causing a low volume of export from Nigerians and also recommend the way out of these challenges. It was observed that the reason why many businesses failed in export or could not continue after one or two shipments is that they are not well-positioned for doing business abroad and therefore not ready for internationalization. This was why the author decided to critically evaluate the degree of export readiness among Nigerian businesses. The outcome of this research showed that only 3% of Nigerian businesses are ready for a successful and sustainable business in the export markets. The research revealed that out of the readiness criteria that positioned a business for internationalization, only criteria like promoters and purpose have more than 50% of the respondents showing a strong conviction that they have met the criteria as shown in Figure-11 below. More than 50% of the respondents have at least 12 criteria that they need to work on. These are the areas that Nigerian businesses majorly need support to improve and become export-ready.

Table-11

Areas of Improvements of Businesses for Export Readiness

In with the reframed Uppsala-based pre-internationalization model, it was observed that the stimuli for internationalization received by Nigerian businesses are not strong enough to motivate them to elicit the psychological and attitudinal commitment needed for them to commit their time energy, and money to develop the capacity required to overcome export readiness factors that hinders them from doing business abroad. It is therefore recommended that the government through the Nigerian Export Promotion Council and the executives of the various OPS in the country need to aggressively promote the products, profits, potential and preferential treatment given to businesses that export abroad especially under the AfCFTA.

This research aims to evaluate the degree of readiness of Nigerian businesses for exportation under the AfCFTA. Based on the analysis of data obtained from businesses in Nigeria during this study, it can be concluded that about 97% of Nigerian businesses, especially SMEs, are not positioned for internationalization and hence are not ready to do business in the export market. Therefore, only about 3% of the businesses in the country are export-ready and therefore the degree or level of readiness of Nigerian businesses for export markets is very low. This, therefore, explains the reason for the low export volume from Nigeria despite the huge export business opportunities available in the country.

Author: Bamidele Ayemibo

References

Alan Bryman (2012) Social Research Methods. Oxford University Press. Retrieved March 9, 2021, from https://www.researchgate .net/profile/Yousef_Shahwan4/post/What_is _the_best_and_the_ most_recent_book_in_medical_research _methodology/attachment/59d6525179197b80779aa 90f/AS%3A511717807321088%401499014441133/download/Social+Research+Meth ods.pdf

Cavusgil, S. T. (1980) On the internationalization process of firms, European Research, Vol 8, no 6, pp 273- 281.

ECOWAS (2019). Economic Community of West African State Approved Enterprises and Products. Retrieved Aug us t 18, 2020 from https://etls.ecowas.int/approvedenterprises- and- products/

Elzana Kadric and Teodora Rangelova (2013). When is a firm ready to go abroad? An analysis of SME internationalization readiness. Retrieved August 18, 2020, from http://www.divaportal.org/smash/get/diva2:636611/fulltext01.pdf

Gankema, H.G., Snuif, H.R. & Zwart, P.S. (2000) The internationalization process of small and medium-sized enterprises: An evaluation of stage theory, Journal of Small Business Management, Vol 38, no 4, pp 15- 27.

Hollensen, S. (2017). Global marketing (7th ed.)- Pearson - Harlow, England.

International Trade Center (2018). A business guide to the African Continental Free Trade Area Agreement. Retrieved August 11, 2020, from https://www.intracen.org/uploadedFiles/intracenorg/Content/Publications/AfCFTA%20Business%20Guide_final_Low- res.pdf

Johanson, J. & Vahlne, J.- E. (1977) The internationalization process of the firm-a model of knowledge development and increasing foreign market commitments, Journal of International Business Studies, Vol 8, no 1, 23- 32.

Johanson, J. and Wiedersheim-Pau l, P.F. (1975) The Internationalisation of the Firm-Four Swedish Cases, Journal of Management Studies, Vol 12, no 3, pp 305-322.

National Bureau of Statistics (2019). National MSMEs Survey Report. Retrieved March 9, 2021, from https://www.nigerianstat.gov.ng/download/967

National Bureau of Statistics (2019) Foreign Trade in Goods Statistics (Q4 2019). Retrieved March 25, 2021, from https://nigerianstat.gov.ng/elibrary?page=3&offset=20

PricewaterhouseCoopers (2019). AfCFTA: Thriving in a New Africa. Retrieved August 11, 2020, from https://www.pwc.com/ng/en/assets/pdf/afcfta- 2019.pdf

Tan Alvin, Brewer Pau l & Liesch Peter W. (2006). Measuring the Internationalisation Readiness of Firms. International Business Review, 16(3), pp. 294- 309. Retrieved November 17, 2020, from https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.666.4167&rep=rep1&type= pdf

Tan, A., Brewer, P. & Liesch, P. W. (2007) Before the First Export Decision: Internationalisation Readiness in the Pre-Export Phase, International Business Review, Vol 16, no 3.

Tralac (2019). The African Continental Free Trade Area-A Tralac Guide. Retrieved August 11, 2020 from https://www.tralac.org/documents/resources/booklets/3028- afcfta-atralac-guide-6th-edition-november- 2019/file.html

WTO (2015). International Trade Statistics. Retrieved August 10, 2020, from https://www.wto.org/english/res_e/statis_e/its2015_e/its2015_e.pdf